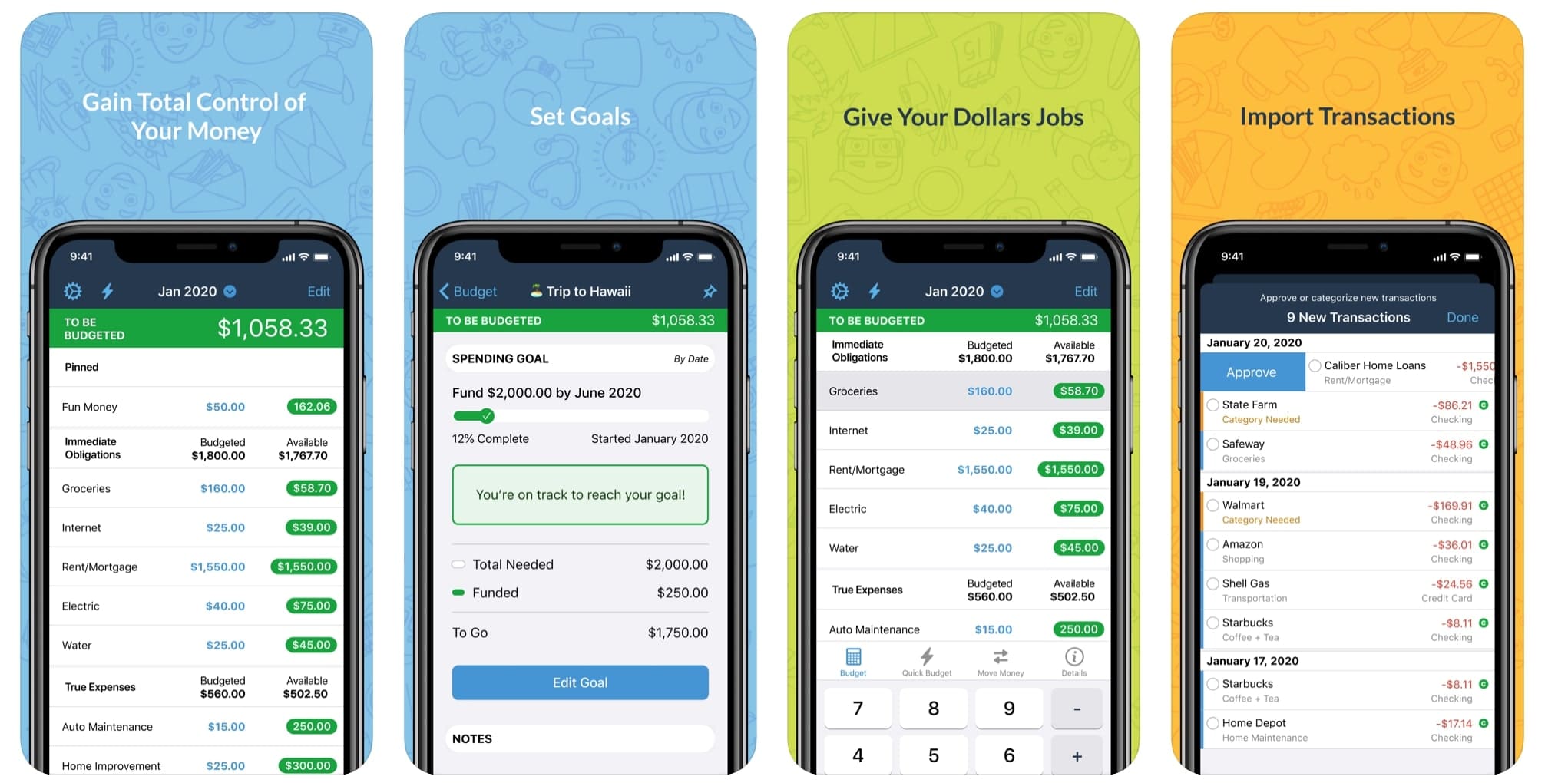

Stop living paycheck-to-paycheck, get out of debt, and save more money with YNAB (You Need A Budget)—the proven method and budgeting app that gives you real results. On average, new budgeters save $600 in their first two months and more than $6,000 in their first year.

YNAB isn't just another expense tracker. It's a proactive system designed to put you in control of your finances. Based on four simple but powerful rules, YNAB helps you break the cycle of financial stress and build a future you're excited about. It requires a shift in mindset, but the payoff is total control and peace of mind.

The YNAB Method - Four Simple Rules:

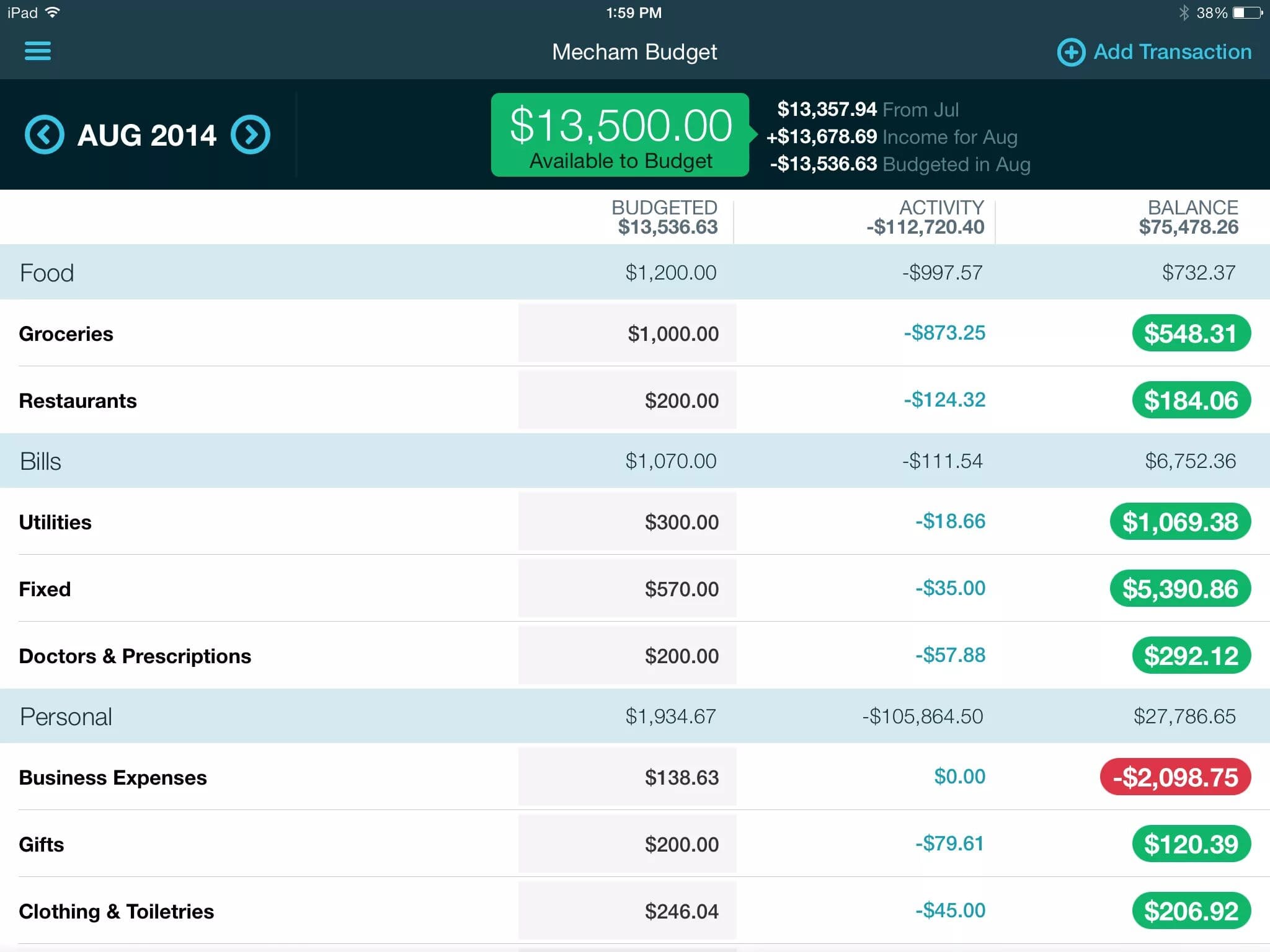

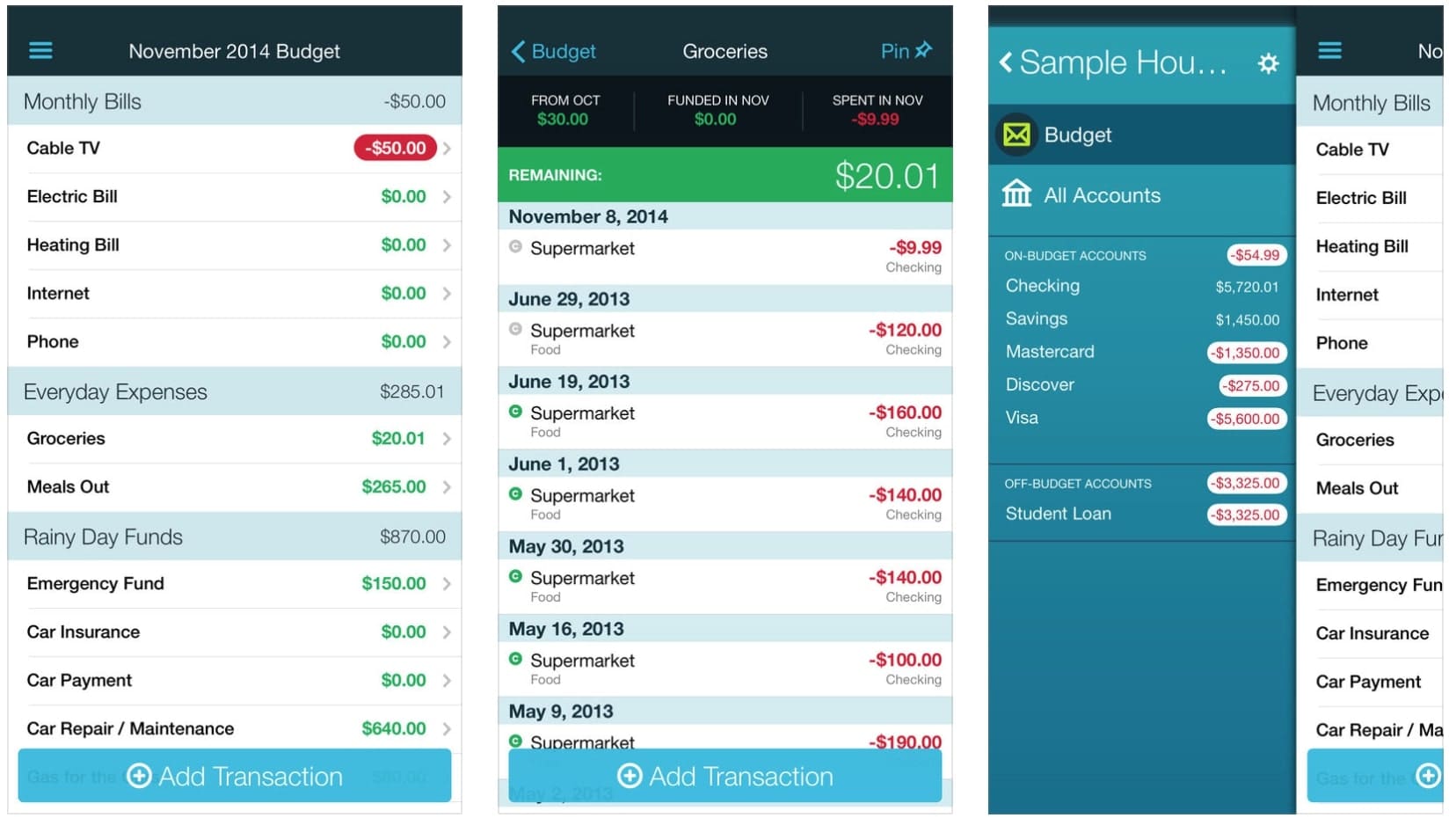

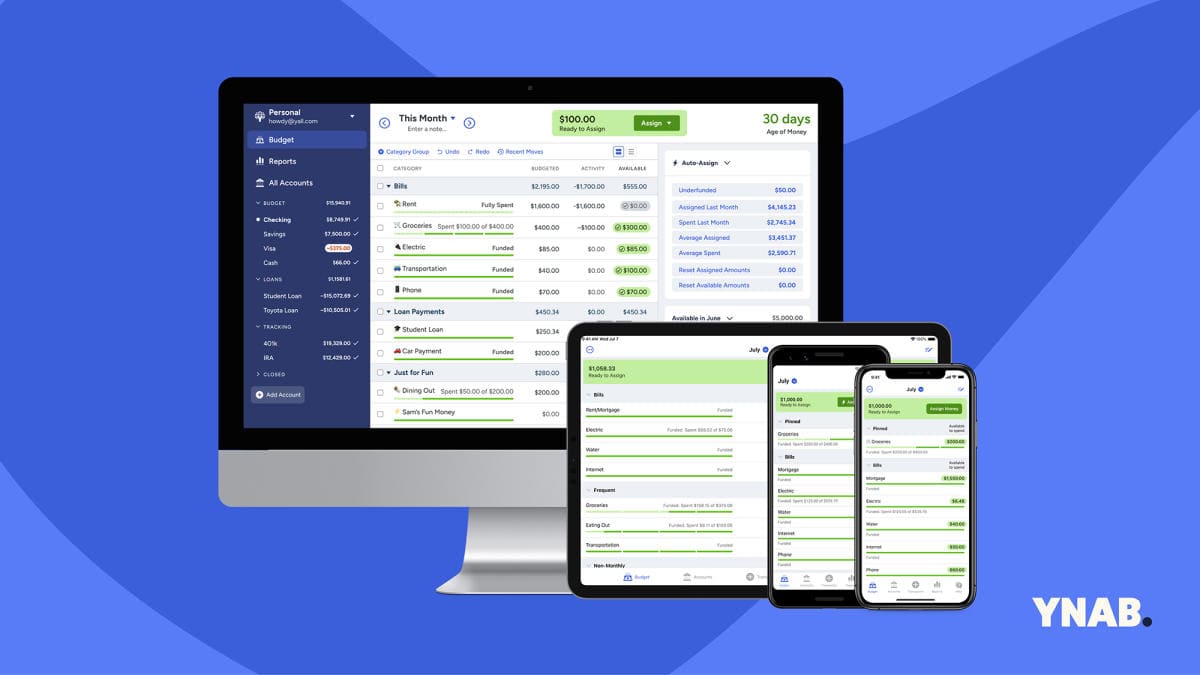

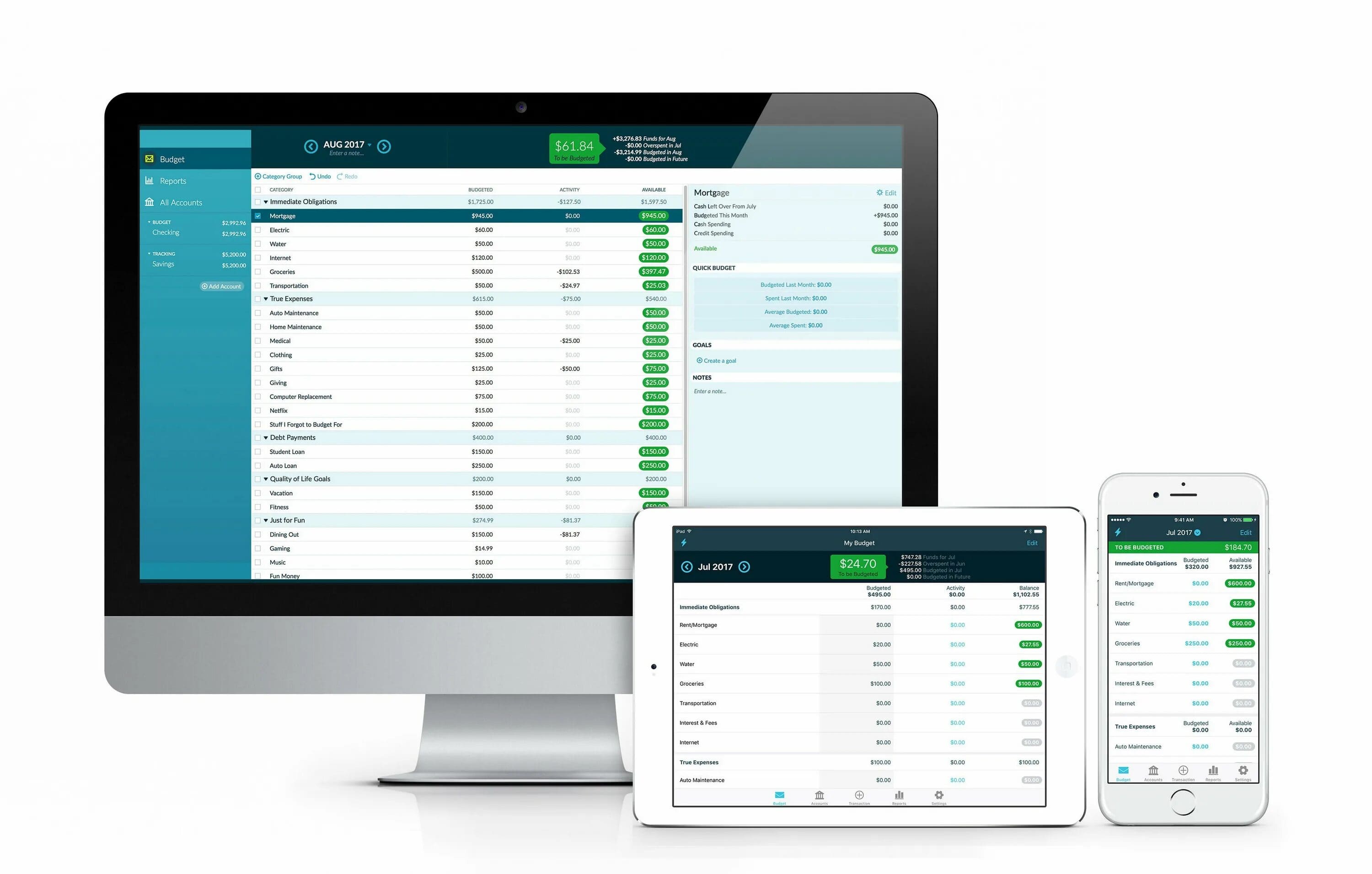

- Rule One: Give Every Dollar a Job. Be intentional about what you want your money to do before you spend it. Allocate funds to categories like rent, groceries, fun money, and debt payments.

- Rule Two: Embrace Your True Expenses. Break down larger, less frequent expenses (like insurance, holidays, or car repairs) into manageable monthly "bills." When the expense arrives, the money is already there.

- Rule Three: Roll With the Punches. Budgets change because life changes. If you overspend in one category, move money from another. No guilt, just flexibility. Your budget adapts with you.

- Rule Four: Age Your Money. Aim to spend money that's at least 30 days old. This breaks the paycheck-to-paycheck cycle and provides a financial buffer, reducing stress significantly.

Key Features:

- 🏦 Bank Sync: Securely link your bank accounts and credit cards to automatically import transactions, saving you time and ensuring accuracy. Manual entry is also fully supported.

- 🎯 Goal Tracking: Set financial goals for anything—a down payment, debt payoff, vacation—and track your progress visually. YNAB helps you allocate funds consistently.

- 📊 Insightful Reports: Understand your spending habits, track your net worth growth, and see how close you are to aging your money with easy-to-understand charts and graphs.

- 📱 Cross-Platform Access: Access your budget anytime, anywhere with seamless syncing between the web app and native mobile apps (Android & iOS). Share your budget with a partner for collaborative financial management.

- 🔒 Secure: Your data is protected with bank-level encryption and robust security practices.

- 🎓 Education & Support: Access free workshops, articles, podcasts, and a supportive community forum to help you master budgeting and achieve your financial goals. Award-winning customer support is ready to help.

Ready to finally gain control of your money and reduce financial stress? Download YNAB and start your free trial today. Experience the clarity and confidence that comes from knowing exactly where your money is going and having a plan for the future.

March 5, 2025

March 5, 2025